The U.S. Energy Information Administration (EIA) last week announced that increasing U.S. ethane production led to record natural gas plant liquids (NGPL) production in 2017.

EIA’s report highlights the incredible progression that’s taken place over the last eight years in regard to U.S. NGPL production:

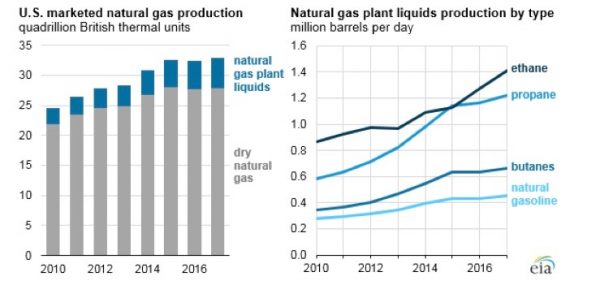

“U.S. natural gas plant liquids (NGPL) production has nearly doubled since 2010, outpacing the rate of natural gas production growth and setting an annual record of 3.7 million barrels per day (b/d) in 2017. NGPLs are produced at natural gas processing plants, which separate liquids from raw natural gas to produce pipeline-quality dry natural gas. Marketed natural gas includes both NGPLs and dry natural gas.”

Common NGPL’s include ethane, liquefied petroleum gases (propane, normal butane, and isobutane), and natural gasoline, according to the EIA.

Source: EIA

And what’s behind this dramatic increase in NGPLs? You guessed it – increasing shale development across the U.S. – with the Appalachian Basin leading the charge.

As EID reported late last year, the region is driving U.S. development of natural gas with record-setting production over the past five years:

Source: EIA

Indeed, the EIA report confirms the prevalence of wet gas – natural gas that contains compounds like ethane and butane in addition to methane – in the Appalachian Basin also explains why it is driving NGPL production.

“Growth in U.S. natural gas production has been driven by shale gas, particularly from the Appalachian region… The high liquids content of many shale plays means that growth in marketed natural gas production has led to increased production of NGPLs.”

Put another way, as U.S. shale development in the wet gas-rich Appalachian Basin continues to increase, so too does the production of a wet gas like ethane.

The EIA report also notes it is the “expanded capacity to produce, transport, and consume NGPL products” that is leading to this climb in NGPL production. Over the past several years, natural gas and NGPL production and processing capacity in the Appalachian Basin has grown dramatically in direct correlation to the development of the Marcellus and Utica Shale formations in the region:

Source: EIA

As you can see on the map, the Appalachian Basin has seen an uptick in NGPL production in the region thanks to a number of new processing plant projects coming online over the past few years. MarkWest, for example, has spent billions of dollars in Ohio alone on their processing plants, which include:

- A Cadiz processing plant that separates methane and ethane from a mixed stream of natural gas liquids and transports the products in separate pipelines.

- A Seneca processing plant that separates methane from a mixed stream of natural gas liquids.

- A Hopedale fractionator, which separates a mixed stream of natural gas liquids into purity products, including butane, isobutane, propane and natural gasoline.

Ethane can be broken down into ethylene – the building block of petrochemicals – at cracker facilities like the Shell ethane cracker in western Pennsylvania and the proposed PTT Global Chemical ethane cracker project in Ohio.

These facilities separate ethane from raw natural gas, and convert it into derivatives – like polyethylene – that are used to make the products we use every day.

Source: Shell Appalachia

As we’ve highlighted several times, the shale gas revolution is spurring plastics manufacturing growth in the region, and the future for the industry in the Appalachian Basin looks bright.

Because of the geological gifts and geographical advantages of the region, it is being eyed for its suitability for chemical and plastic manufacturing industries to set up shop. These investments would bring incredible benefits to the workforce, and the economies of the Appalachian region as a whole. As American Chemistry Council President Cal Dooley previously explained:

“The Appalachian region has distinct benefits that could make it a major petrochemical and plastic resin-producing zone. Proximity to a world-class supply of raw materials from the Marcellus/Utica and Rogersville shale formations and to the manufacturing markets of the Midwest and East Coast has already led several companies to announce investment projects, and there is potential for a great deal more.”

Source: Appalachian Storage Hub Conference, Source: Heather Rose-Glowacki, American Chemistry Council

As the build-out of natural gas storage and pipeline infrastructure unfolds, all of the tri-state (Ohio, Pennsylvania, West Virginia) will be better positioned to take advantage of a number of large-scale investments. It’s because of the potential of the region that Shale Crescent is working relentlessly to attract more investment from industries like plastics and other petrochemical facilities.

At the end of the day, the EIA report is another in a long line of indicators that the Shale Crescent stands to be the beneficiary of the considerable bounty the shale revolution has to offer – jobs, the return and growth of industry, tax revenue generated for the state, and significant investments that can dramatically improve the economic health of the region.

No comments:

Post a Comment