Shale Directory’s recent Upstream PA 2018 conference held in State College focused on the tremendous positive impact that the Marcellus Shale has had on Pennsylvania over the last decade and what to expect for the rest of 2018. Speakers included:

- Pa. House Speaker Mike Turzai (R)

- Dave Spigelmyer, Marcellus Shale Coalition

- Stephanie Catarino-Wissman, Associated Petroleum Industries of Pennsylvania

- Mike Killion, EQT

- Tom Gillespie, Inflection Energy

- George Stark, Cabot Oil and Gas

- Rob Boulware, Seneca Resources

- Curtis Wilkerson, Orion Strategies

- Jude Clemente, JTC Energy Research Associates

- Jim Willis, Marcellus Drilling News

- Dr. Terry Engelder

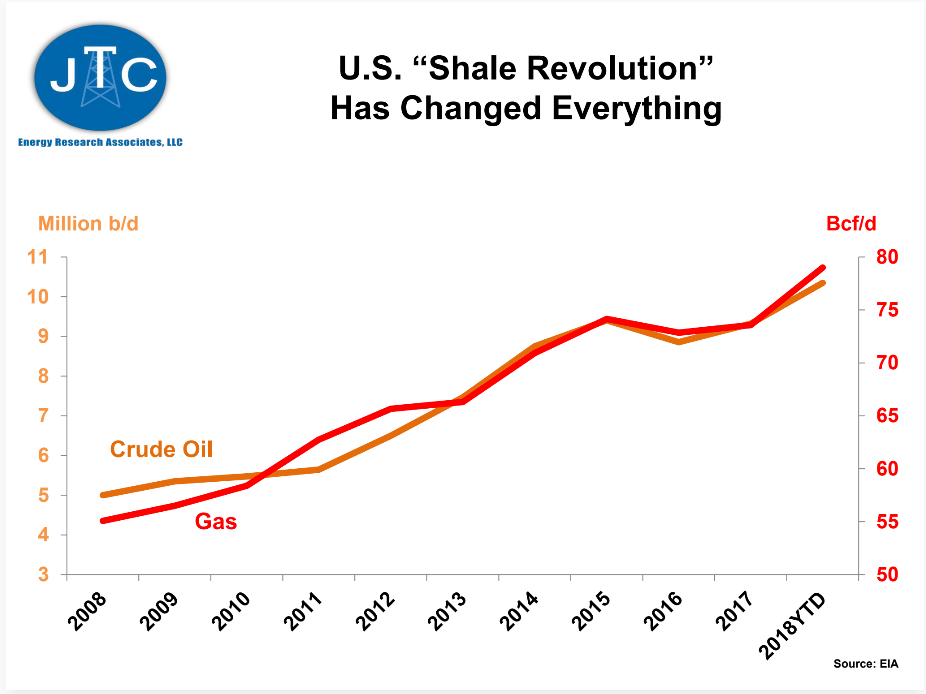

The overall message was positive, with multiple speakers describing the game-changing opportunities in Pennsylvania made possible by shale. As Jude Clemente, principal of JTC Energy Research Associates and a frequent Forbes contributor, said, “Shale has changed everything.”

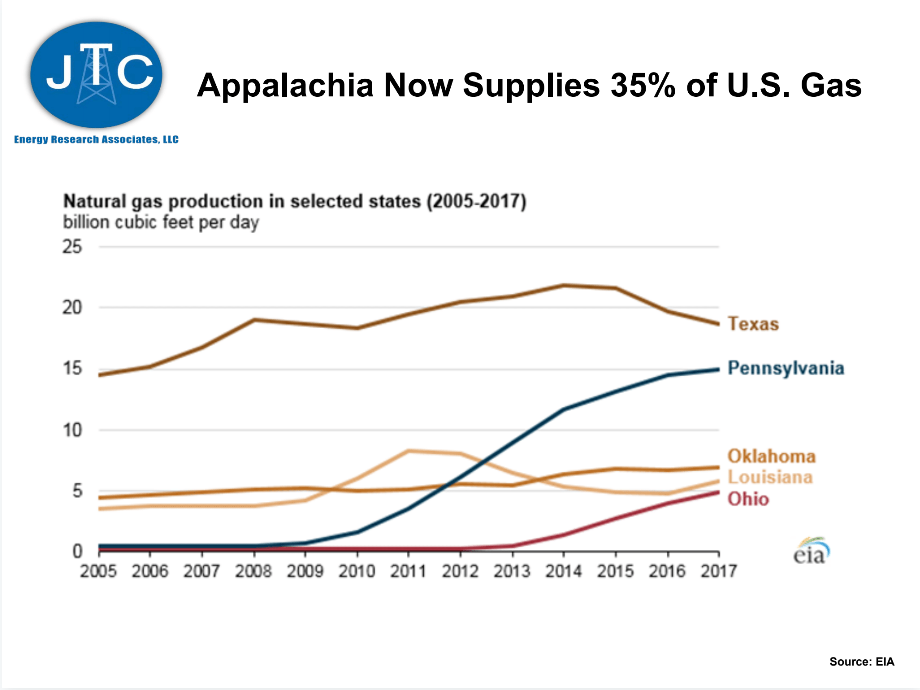

And indeed it has. Marcellus Shale Coalition (MSC) president David Spigelmyer explained that there have been over 10,000 unconventional wells drilled in Pennsylvania, with over 8,200 of those now in production. Those wells produced about 5.4 trillion cubic feet (Tcf) of natural gas in 2017, and the Commonwealth is currently producing more than 15 billion cubic feet (Bcf) of natural gas every single day.

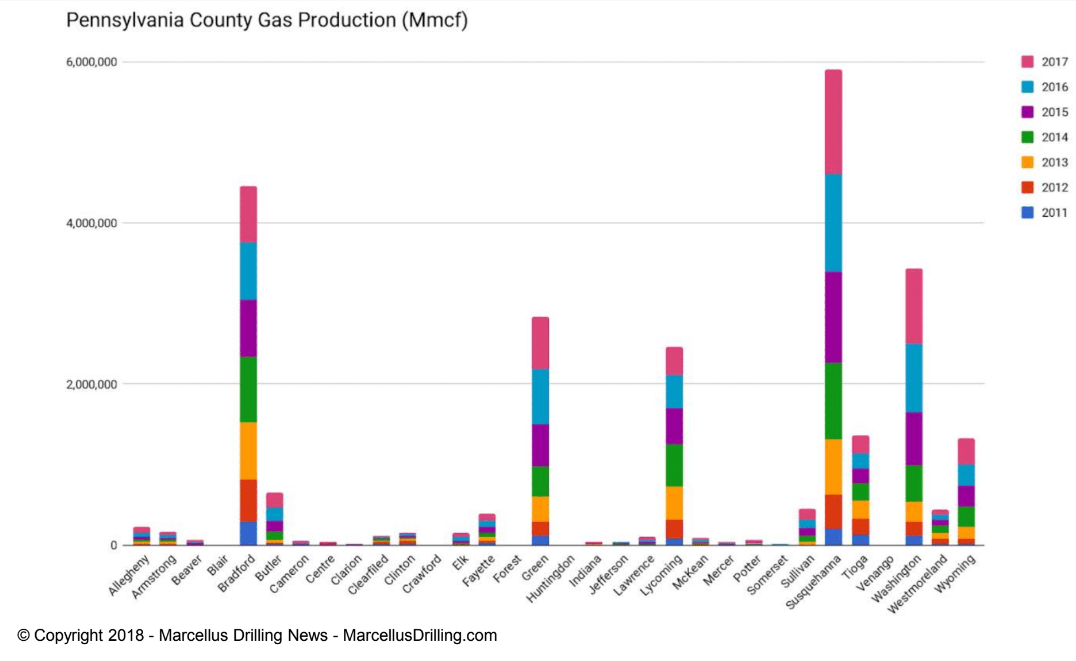

Marcellus Drilling News’ Jim Willis shared that Pennsylvania’s top producing counties are Susquehanna, Bradford, Washington, Greene and Lycoming, while Chesapeake Energy, Cabot Oil and Gas, Range Resources, EQT and Southwestern Energy are the Commonwealth’s top producing companies. To give perspective on just how much gas these companies are producing, Cabot’s Director of External Affairs George Stark explained that his company will increase its production from 2 Bcf per day to 3 Bcf every day when the Atlantic Sunrise pipeline comes online later this year!

That record-breaking production has resulted in major economic benefits, as Spigelmyer explained,

“This industry has created three Amazons in Pennsylvania, without one subsidy request.”

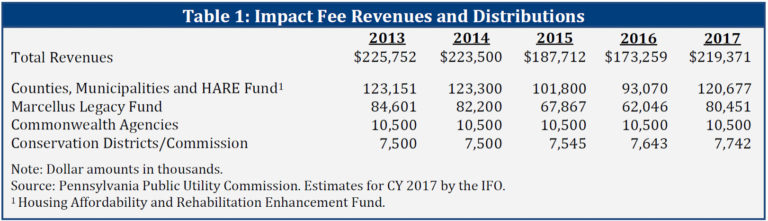

Pa. House Speaker Mike Turzai (R) explained that some of those benefits include an impact fee (a tax on wells drilled) that “no one else in the country has” that “goes back to the local communities where development is happening.” Spigelmyer explained that,

“These local impact fee revenues are game-changers for rural Pennsylvania.”

With the estimated $219.4 million impact fee disbursement that will be distributed over the summer, the shale industry will have paid over $1.5 billion in impact fees since 2011.

As the above fee distribution breakdown demonstrates, most of that money stays in the counties and municipalities where development occurs, although every county receives some portion of the fee. Impact fee money can be used for everything from infrastructure improvement to emergency services to workforce training as the following charts show:

Spigelmyer also told attendees,

“We need to be proud of the industry we represent. We’ve made game-changing achievements not only for the state, but the country.”

This sentiment was echoed by Rep. Turzai who opened his presentation with an expression of gratitude for the many companies representing all segments of the oil and gas lifecycle that were present, saying,

“You are doers. You are people who are on the front line and should be celebrated for the work you are doing in Pennsylvania.”

“The benefit to everyday Pennsylvanians, whether you’re upstream, midstream or downstream, needs to be told over and over. ”

Seneca Resources’ Rob Boulware explained that for every well drilled, his company spends about “$47 million buying goods and services from businesses in Pennsylvania.” And Stark described how Cabot has paid over $1 billion in royalties to property owners in Susquehanna County, in addition to other investments the company has made in the community.

But, as Rep. Turzai said, it’s not just upstream benefits that have been realized by the Commonwealth. New investments in the state have also occurred thanks to the abundance of natural gas and natural gas liquids in the region, such as the $6 billion Shell cracker plant that, as Rep. Turzai explained, will create roughly 6,000 jobs during construction and 600 permanent jobs. The Shale Crescent region can support five to six more of those facilities, and plans are already in the works for a second facility in Ohio. These facilities will provide a valuable feedstock for plastics manufacturing, presenting another potential economic development opportunity. As Rep. Turzai said,

“Plastics can be used in containers, diapers, crayons…why are we not talking about getting those manufacturing facilities located in southwest Pennsylvania by that cracker facility?”

The increased natural gas-fired electricity being generated in the Northeast is another notable end-use benefit of Marcellus shale development. As Willis discussed, about 21 of the total 32 gigawatts of planned new U.S. electricity generation slated for 2018 will be gas-fired, with about 43 percent of that new natural gas-fired electricity located in the Marcellus-Utica region. This continued increase in natural-gas fired electricity generation has led to the cleanest air the country has seen in decades, as Clemente discussed in his presentation.

Clemente also discussed another important benefit of the shale revolution: low-cost energy. He emphasized to attendees to “never forget how important it is to have low-cost energy,” noting that much of Europe is in a state of energy poverty, where older populations especially are at greater risk because of high energy costs. He explained,

“A pipeline build-out is coming in Appalachia. The natural gas is here, the demand is rising — we don’t have a choice. We have to produce more because electricity is such an important commodity.”

Of course, not everyone in the Northeast has made a connection between the need for low-cost energy and the pipelines needed to make it a reality. Several speakers described the high energy costs that have resulted from policy decisions and blocking important infrastructure projects in New York in particular. Willis explained that when it comes to pipelines,

“The idea behind the state issuing permits is not so they can veto a project, but to guide it. New York has taken that to an extreme.”

As Clemente explained, both New York and New England will need pipelines to meet growing natural gas demand.

Nonetheless, decision-makers in these states have bowed to “Keep It In the Ground” interests, and as Clemente said,

“The anti-pipeline movement hurts families and businesses. There are higher costs for energy where pipelines have been blocked and delayed.”

As the above chart shows, and Spigelmyer said,

“Policies that have discouraged or blocked pipeline development in the Northeast are having direct and significant impact to all levels of consumers.”

Spigelmyer further illustrated this fact by noting that New York City consumers were paying $175 per MMBtu in January at the same time Pennsylvanians were paying less than $5 per MMBtu.

At the end of the day two things were very clear: The shale revolution has had a tremendous positive impact on Pennsylvania, and this is only the beginning. As Spigelmyer explained,

“We’re still in the first inning of a nine inning game. …I think what we have here is game-changing.”

No comments:

Post a Comment